Dignity Health - St. Rose Dominican Hospital, San Martin Campus, Las Vegas, NV, can earn VBP incentives by reducing MSPB costs by 5.6%

Get Dexur’s Personalized Hospital Specific Presentation on Quality, Safety, Compliance & Education

By: Debasish Choudhury Jun. 11, 2021

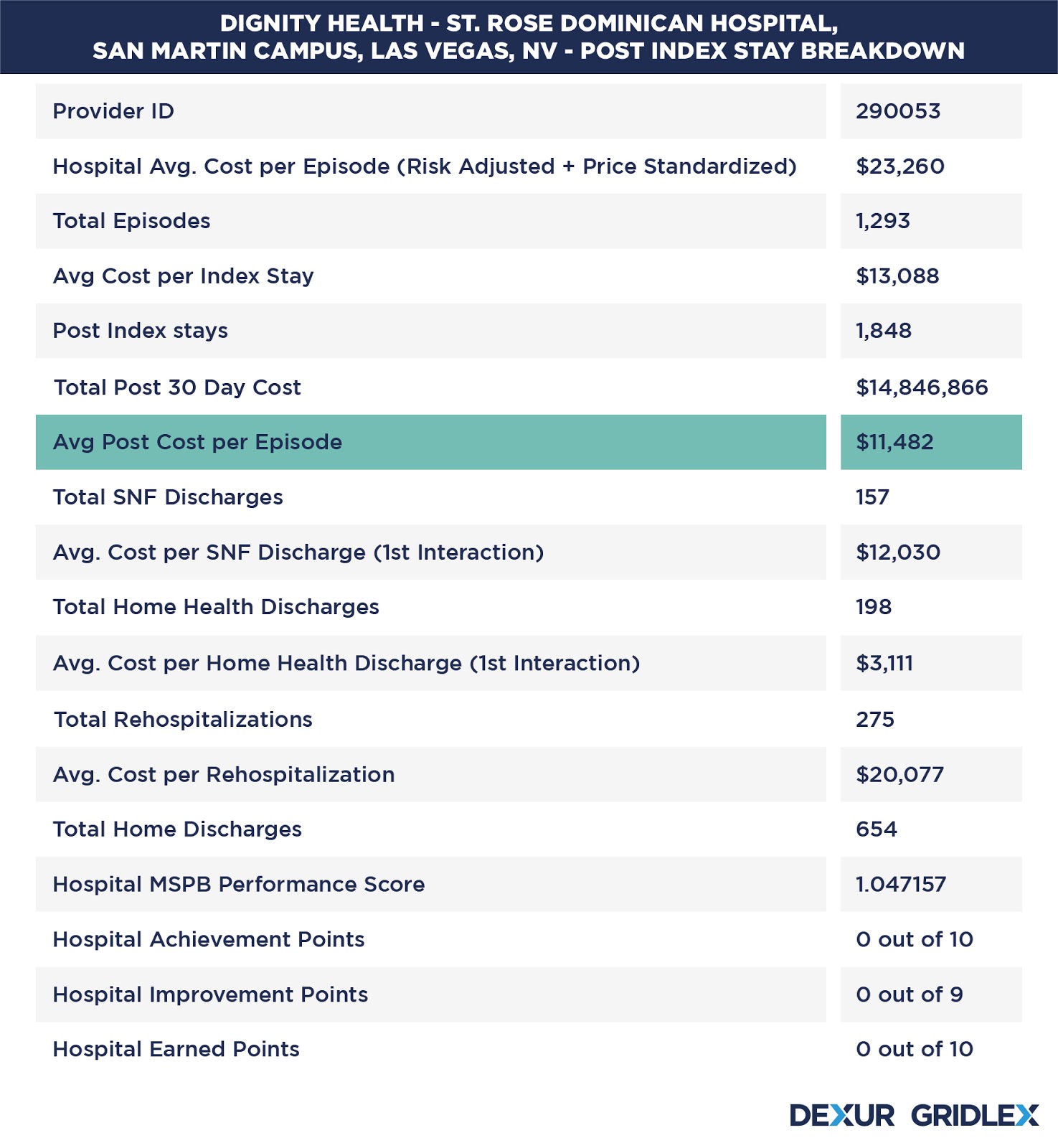

Dignity Health - St. Rose Dominican Hospital, San Martin Campus, Las Vegas, NV, reported a CMS Value Based Purchasing (VBP) adjustment factor of 0.9952 in the year 2021, which could result in an estimated penalty of $111,794. Medicare Spending Per Beneficiary (MSPB) accounts for 25% of overall VBP score and is a significant factor in driving VBP payments. MSPB costs include the costs from 3 days before hospitalization, index hospital stays, and 30 days post-discharge. The measure score of the Efficiency & Cost Reduction domain for Dignity Health - St. Rose Dominican Hospital, San Martin Campus during the period was 0/10. Dexur is an approved purchaser of CMS Medicare claims data and based on our simulator, we estimate that Dignity Health - St. Rose Dominican Hospital, San Martin Campus can avoid VBP penalties by reducing MSPB Cost by 5.6%.

Dignity Health - St. Rose Dominican Hospital, San Martin Campus’s average MSP B cost per episode (risk adjusted and price standardized) for the period of January 2019 to December 2019 was $23,260.The average cost of post Index Stays was $11,482 with a total of 1,293 episodes.

Dexur Simulator for MSPB Cost Reduction

Dignity Health - St. Rose Dominican Hospital, San Martin Campus can achieve the break-even VBP adjustment factor of 1 by earning 3 points in MSPB and thereby avoid VBP penalties to achieve incentives. Hospitals need to reduce post Index hospitalization costs to meet these MSPB reduction targets. Dexur’s simulator has identified four main levers and estimated reduction in each of these levers to reduce MSPB to the target levels and ultimately achieve a positive MSPB score:

-

Reduction in rehospitalizations: 19% shift can cause 3.3% reduction in MSPB cost and impacts 52 episodes.

-

Shift from SNF discharge to home: 19% shift causes 1.1% reduction in average MSPB cost and impacts 29 episodes.

-

Shift from SNF discharge to Home Health Agency: 19% shift causes 0.8% reduction in average MSPB cost and impacts 29 episodes.

-

Shift from Home Health Agency to Home: 19% shift results in 0.4% reduction in average MSPB cost and impacts 37 episodes.

In Summary, the four levers impact 147 episodes and reduce MSPB costs by 5.6% and improve the MSPB performance rate to 0.988. This increases the VBP adjustment factor to 1.0

and helps attain a perfect break even.

A higher reduction in Post Index stay costs can further improve the VBP score to attain incentives. For example, a 35% reduction in post index stay costs can reduce the average MSPB cost by 10.3%, and earn a VBP Adjustment Factor of 1.0033, thereby achieving an incentive of $76.8k.