Sunshine Act Reporting Management with Dexur | Back to Life Sciences App Suite

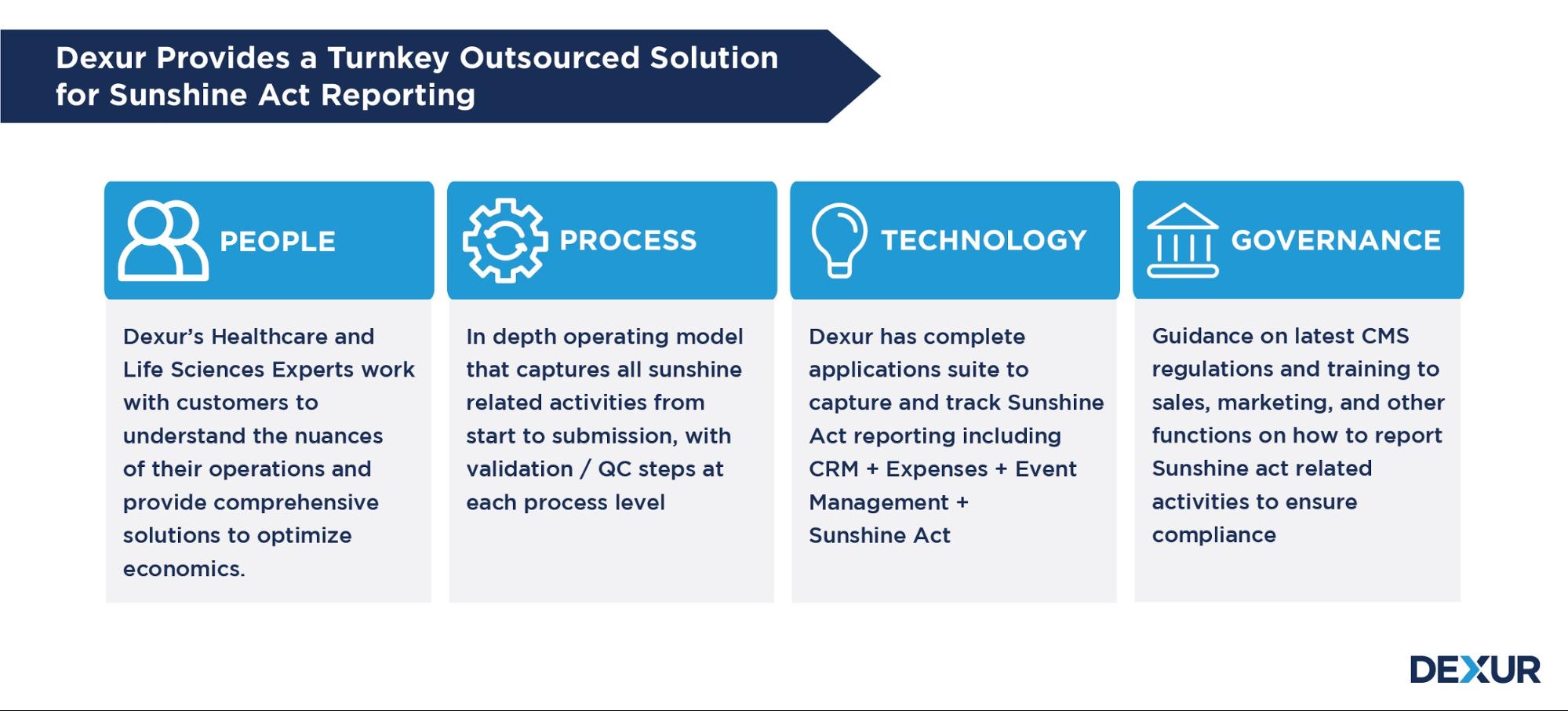

Staying compliant with the federal Sunshine Act reporting is an arduous task as organizations engage with speakers and KOLs. Any inaccuracy in reporting not only attracts fines, but can also affect the organization’s reputation and physician relationships. Dexur provides the necessary tools and expertise to simplify and streamline this process, saving time and resources spent manually tracking, mapping and verifying the various reportable payments.

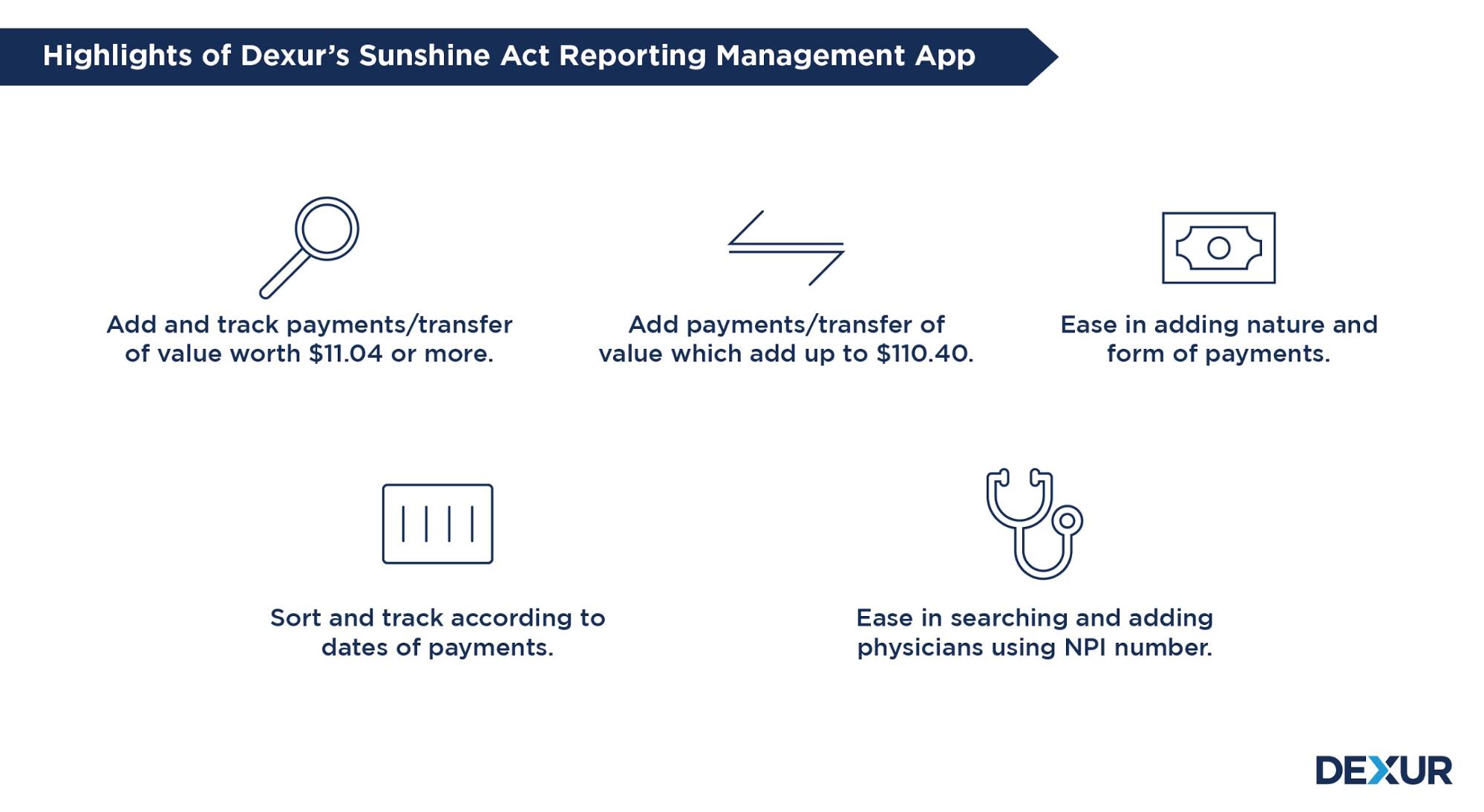

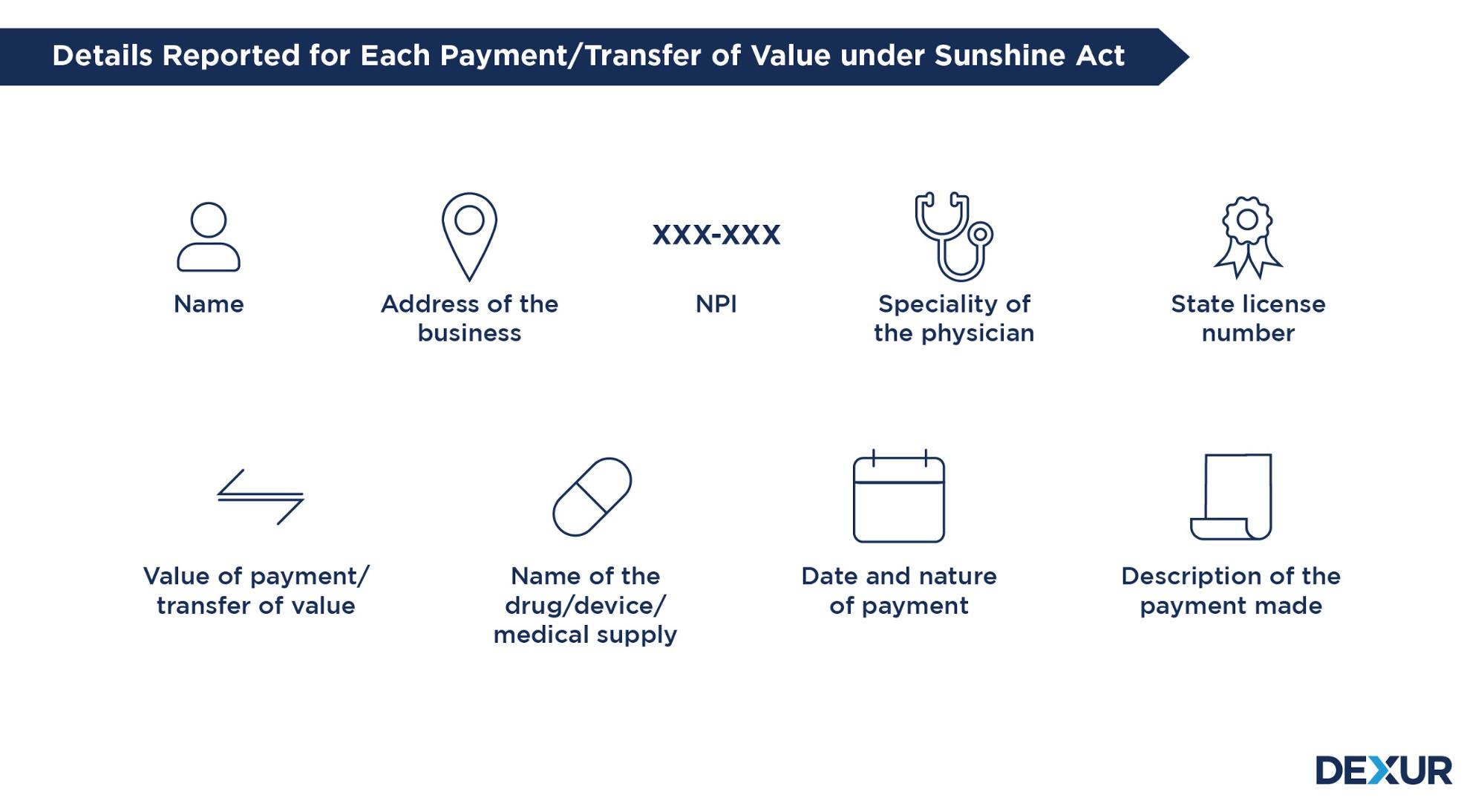

Dexur’s Sunshine Act Reporting Management App provides features that include tools for easy reporting, tracking payments in one place, and managing aggregate spending according to the reporting thresholds. Our operating model and processes are aligned with the latest regulations on covered entities, reportable payments/transfers of value & thresholds and other nuances of Sunshine Reporting.

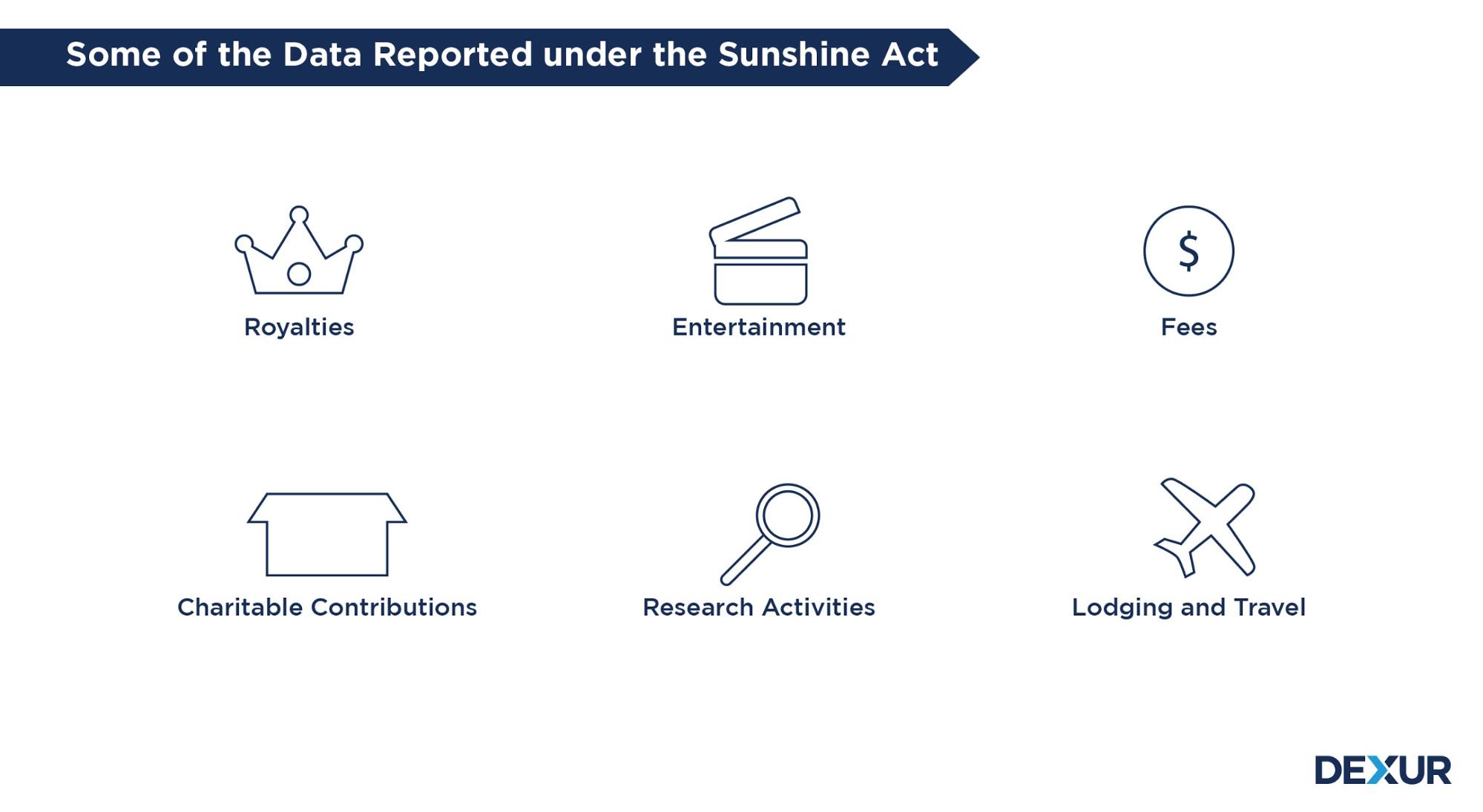

CMS lists 16 Nature of Payment categories to describe the various kinds of financial transactions to be reported under the Sunshine Act. Some of these categories as defined by CMS are as follows:

Royalties: Payments made on the basis of the sales of products that use a physician’s intellectual property. For example, when a physician works with a device manufacturer to invent a new product, the manufacturer may promise a certain percentage of all device sales in royalties to the physician.

Entertainment: Costs involved in recreational, cultural, sporting or other events.

Consulting Fees: This category includes payments made by manufacturers to physicians who have provided their advice and expertise on a specific medical product or treatment to cater to a particular business need and is typically provided under a written agreement.

Charitable Contributions: CMS defines charitable contributions as any payment or transfer of value made to an organization with tax-exempt status under the Internal Revenue Code of 1986, that is not more specifically described by one of the other categories. For example, the funds donated by a manufacturer to a teaching hospital to help pay for a health education program, can be reported as a charitable contribution.

Research: Payment for different types of research activities, including enrolling patients into studies of new drugs or devices. These payments can include direct compensation to physicians, funding for research study coordination and implementation, or payments to study participants to cover expenses associated with the study.

Lodging and Travel: For example, the costs associated with flying in physicians for training events held at the company headquarters or another location, and the accommodation charges involved can be reported under this category.

Integration with CRM, Event and Expense Management Systems to capture and track all Sunshine Related Activities

Dexur’s Sunshine Act Reporting Management App works in conjunction with other relevant applications in Dexur’s App Suite ecosystem including CRM, Event and Expense Management to capture all Sunshine Act related data and approvals for compliance. Our platform can also connect to other systems via APIs or custom integrations to ease data collection for appropriate reporting & submission.

Use Cases

Scenario: A rep has a lunch and learn event at a doctor’s office

- Rep creates a CRM activity to track the event

- Attendees are created for the event

- Expenses are associated with that lunch and learn event

- Expenses are approved

- Attendees are validated against a common NPI / License database

- Expenses are apportioned across the valid “covered recipients”

- Apportioned expenses are reported for Sunshine Act for the covered entities

Scenario: A rep meets a doctor and shares a reprint of a medical journal

- Rep creates a CRM activity to track the event

- The specific Medical Journal is tracked in the CRM for the event

- The medical journal is associated with a value

- The event and doctor/HCP is validated against a common NPI / License database

- The event/ medical journal event is reported as per Sunshine act rules