How Much Should You Pay for Health Insurance?

Get Dexur’s Personalized Hospital Specific Presentation on Quality, Safety, Compliance & Education

By: James Pitt Nov. 16, 2018

Open enrollment is from November 1 to December 15. If you don't already have health insurance for next year lined up, the best time to enroll is right now. Many plans are available at good values. If you forget to get health insurance, you may need to pay a tax penalty.

Health insurance plans have a lot of details. The most important are the premium and deductible. The premium is how much you pay per month to stay covered. The deductible is how of your own money you'll need to spend on healthcare before the insurance starts picking up costs. (Many plans cover preventative care like a yearly checkup for free, even before the deductible).

Usually there's a tradeoff - plans with high deductibles have low premiums, and vice versa.

Here's a walkthrough of the premiums to expect when you buy health insurance on the exchanges. Health insurance premiums depend on your age, state, and how many people in your family you're covering.

How Much Should You Pay for Health Insurance?

The tax credit makes health insurance easier to buy

Health insurance premiums for common situations

How age affects health insurance

Is cheap health insurance worth moving for?

By state, median monthly premiums for common situations

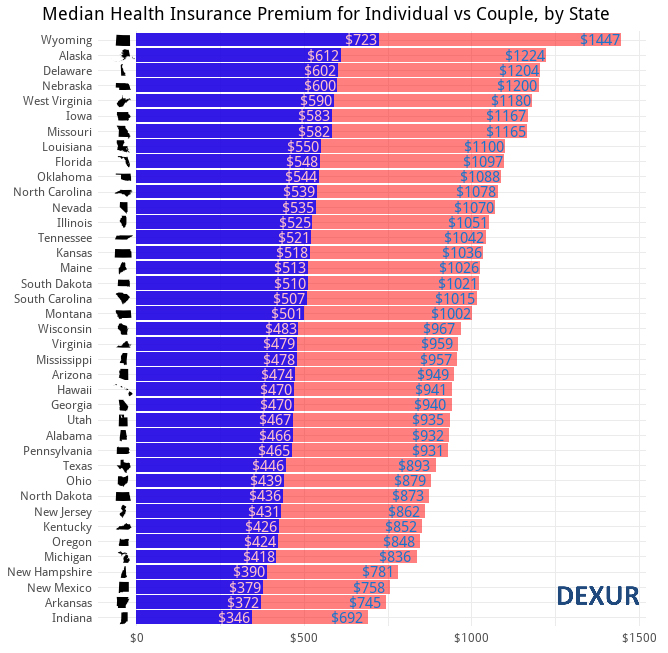

Health Insurance for individuals and health insurance for married couples

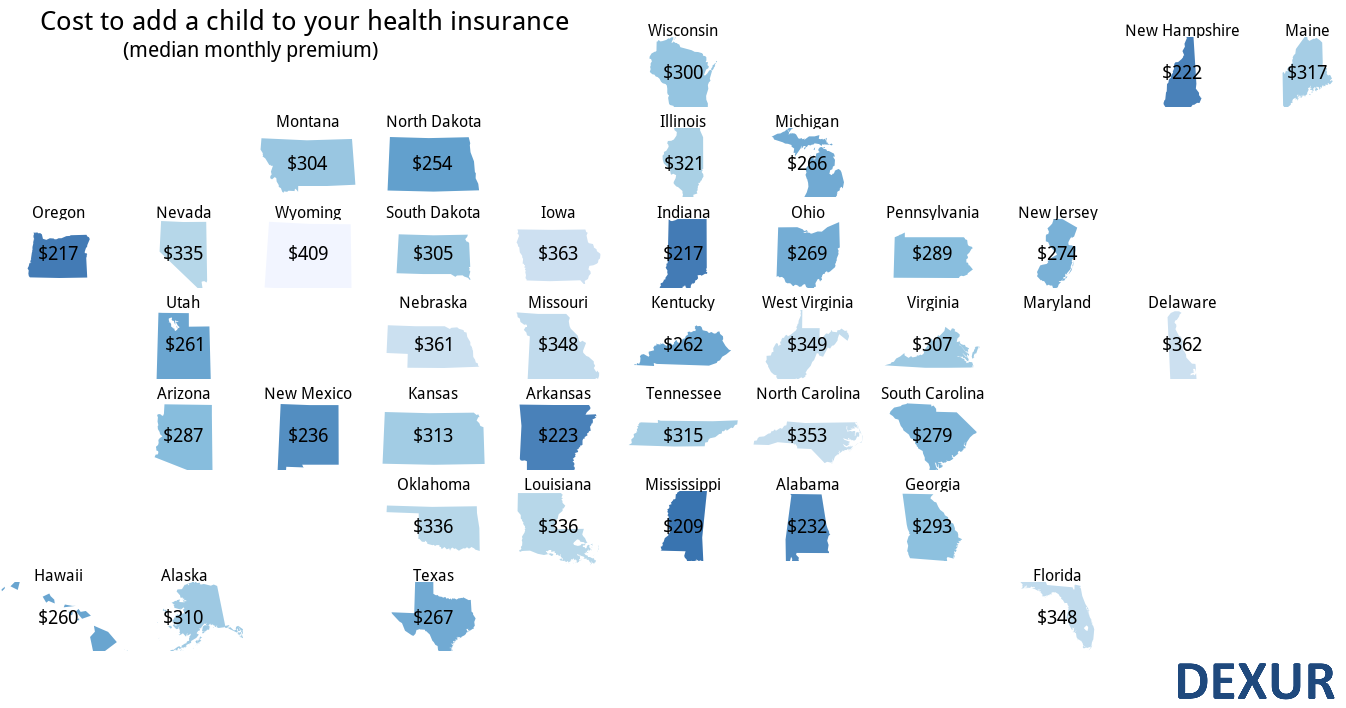

Health Insurance to Cover your Children

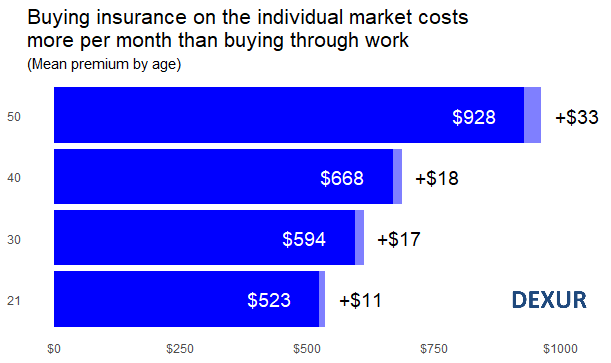

How much will a job help with health insurance premiums?

The tax credit makes health insurance easier to buy

Insurance looks more expensive than it is. This is because many people are eligible for a subsidy, a tax credit, where the government pays much of the price for you. You can find health insurance plans on HealthCare.gov for Americans in 39 states, and the state-specific exchanges linked here for the rest. If you've already taken a look, the premiums probably look high. But most people who buy health insurance through the exchanges are eligible for tax credits that greatly reduce the price.

- Go to the Kaiser Family Foundation calculator and see what tax credit you can expect. Remember to make “Number of people in family” match number of adults + number of children!

- If you qualify for the tax credit - 59% of Americans do - your premiums will come to at most 10% of your income.

- For an exact number, subtract the “Estimated financial help” number the calculator gives from the premium of the plan you're looking at.

Once you know how much financial help you can get, insurance premiums are much less intimidating. The tax credit cuts a typical family's health insurance premiums in half.

The median US household is about 3 people making about $60,000 per year. For a family like this, a typical insurance plan's premiums would cost about $12,000 per year - but the tax credit drops that to about $5,700 per year.

That's one reason why the average private insurance enrollee will pay about $6500 for their insurance in 2019 (source: table 17, National Health Expenditure Data), even though the average yearly insurance premium would be almost double that without it.

Calculate your estimated financial help and keep it in mind as you go through the numbers below. The numbers below are how much your monthly premiums would be without that financial help. (If you're making too much money for financial help: congratulations!)

Health insurance premiums for common situations

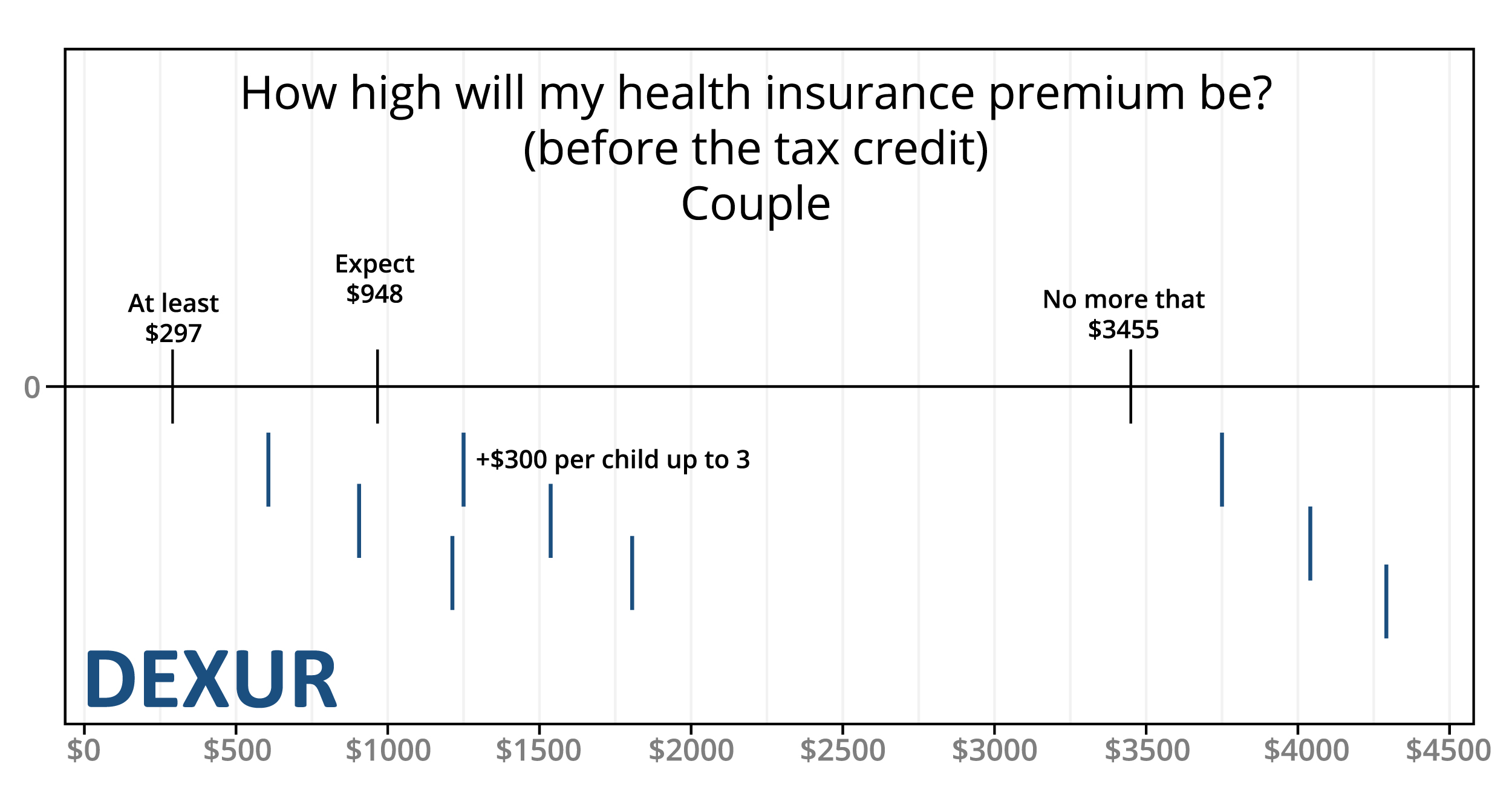

Here are median, lowest, and highest premiums you can expect for common family situations.

| Group | Median | Low | High |

|---|---|---|---|

| Single, age 21 | $378 | $149 | $967 |

| Single parent, age 30 | $716 | $282 | $1838 |

| Couple with 2 kids, age 40 | $1539 | $607 | $3952 |

| Couple with 3 or more kids, age 50 | $1537 | $607 | $3947 |

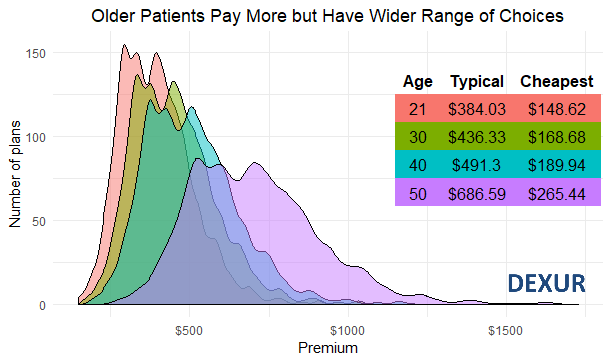

How age affects health insurance

Insurers charge older people higher premiums. The median price for insurance you buy on the individual market to cover just yourself is:

- $384 per month if you're 21

- $436 per month if you're 30

- $491 per month if you're 40

- $687 per month if you're 50

In most states, a single 50-year-old will pay about as much per month as a 40-year-old with a child. People in their 40s should be prepared for their premiums to go up noticeably each year.

The good news is this is what's typical, not what's unavoidable. The median plan at age 50 costs about $450 more than the median plan at age 21. But the cheapest plan at age 50 only costs about $150 more than the cheapest plan at age 21. If you always get the cheapest plan on the individual market, on average you'd pay:

- $149 per month if you're 21

- $169 per month if you're 30

- $190 per month if you're 40

- $265 per month if you're 50

And older people have a wider range of choices than younger people. Most plans for 21-year-olds fall in a very narrow range of premiums. Older people have more room to decide whether they want a cheap plan or a thorough plan.

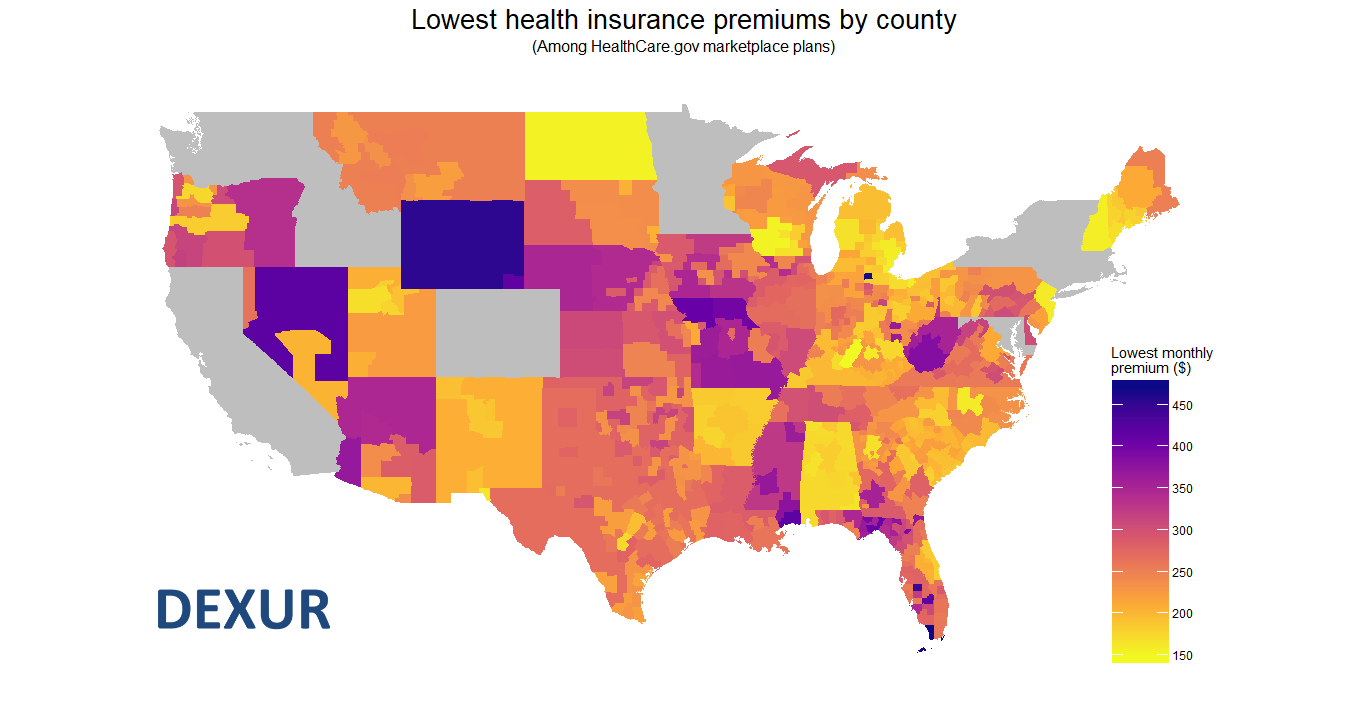

Is cheap health insurance worth moving for?

Premiums tend higher in some states than others. Wyoming and Nebraska have the highest median premiums. This isn't about urban vs rural; Indiana and Arkansas have the lowest median premiums. A typical plan in Wyoming is almost $1000 more expensive than a typical plan in Indiana.

There are a few cases where it would be easy to move to get lower premiums. Nevada has strikingly lower premiums in its more developed center and south, looking like a yellow hammer against the background of its more expensive desert areas. Premiums in Louisiana are much lower than in adjacent parts of Florida, and vary heavily across the Midwest. (States that run their own exchanges rather than using the federal exchange are shown in grey).

By state, median monthly premiums for common situations

| State | Single, age 21 | Single parent, age 30 | Couple with 2 kids, age 40 | Couple with 3 or more kids, age 50 |

|---|---|---|---|---|

| Alabama | $282 | $524 | $1133 | $1096 |

| Alaska | $578 | $1098 | $2361 | $2358 |

| Arizona | $372 | $707 | $1521 | $1519 |

| Arkansas | $302 | $574 | $1235 | $1233 |

| Delaware | $521 | $990 | $2129 | $2127 |

| Florida | $429 | $814 | $1751 | $1749 |

| Georgia | $356 | $677 | $1456 | $1454 |

| Hawaii | $393 | $747 | $1607 | $1605 |

| Illinois | $398 | $756 | $1625 | $1623 |

| Indiana | $282 | $536 | $1152 | $1151 |

| Iowa | $461 | $876 | $1883 | $1881 |

| Kansas | $419 | $796 | $1711 | $1709 |

| Kentucky | $356 | $676 | $1454 | $1453 |

| Louisiana | $445 | $845 | $1818 | $1816 |

| Maine | $406 | $772 | $1660 | $1658 |

| Michigan | $330 | $628 | $1350 | $1348 |

| Mississippi | $379 | $671 | $1451 | $1400 |

| Missouri | $467 | $887 | $1907 | $1905 |

| Montana | $328 | $623 | $1340 | $1338 |

| Nebraska | $491 | $933 | $2005 | $2003 |

| Nevada | $460 | $874 | $1880 | $1878 |

| New Hampshire | $292 | $554 | $1191 | $1190 |

| New Jersey | $395 | $655 | $1408 | $1402 |

| New Mexico | $297 | $564 | $1212 | $1211 |

| North Carolina | $419 | $796 | $1713 | $1710 |

| North Dakota | $383 | $728 | $1565 | $1563 |

| Ohio | $354 | $673 | $1448 | $1446 |

| Oklahoma | $418 | $794 | $1707 | $1705 |

| Oregon | $339 | $600 | $1296 | $1251 |

| Pennsylvania | $368 | $699 | $1503 | $1502 |

| South Carolina | $434 | $825 | $1774 | $1772 |

| South Dakota | $432 | $820 | $1764 | $1762 |

| Tennessee | $407 | $772 | $1661 | $1659 |

| Texas | $342 | $649 | $1396 | $1395 |

| Utah | $318 | $695 | $1446 | $1434 |

| Virginia | $351 | $667 | $1435 | $1433 |

| West Virginia | $479 | $910 | $1956 | $1954 |

| Wisconsin | $389 | $740 | $1591 | $1589 |

| Wyoming | $592 | $1126 | $2421 | $2418 |

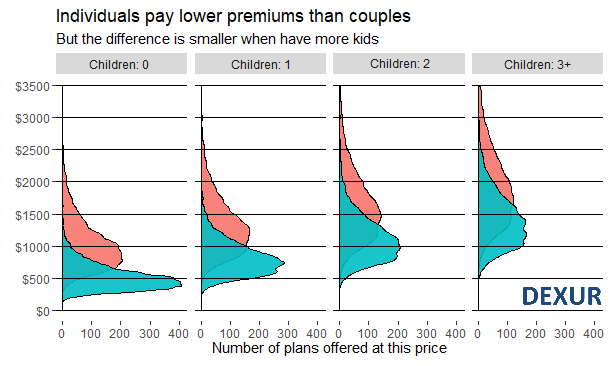

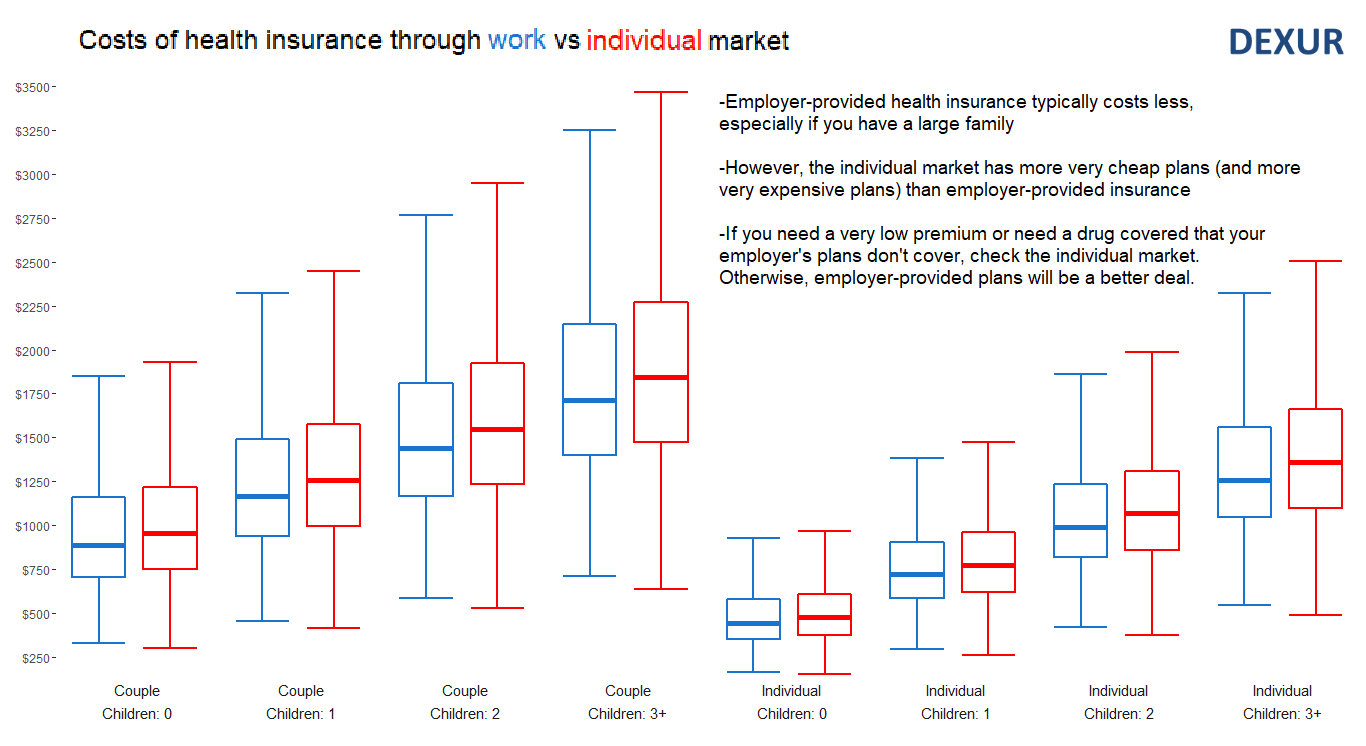

Health insurance for families

Fewer young Americans are marrying and having kids in recent years. They say it's too expensive to start a family. Childcare, housing, and food are all more expensive for millennials than they were for Generation X.

Bigger families pay higher average premiums. The cheapest plan for a couple with three kids costs about as much as a typical plan for a couple with no kids.

Individuals have a narrower range of premiums to choose from than couples have. This does mean generally cheaper plans. But it also means individuals with chronic health problems may have trouble finding a plan with thorough coverage.

Health Insurance for individuals and health insurance for married couples

On average, insurance costs twice as much for a couple as for an individual. But some states are more family-friendly than others. It's cheapest to cover a partner in Indiana, and most expensive in Wyoming. This is the same trend as overall costs.

Health Insurance to Cover your Children

On average, it costs $300 to cover a child. There is no penalty for single parents; single parents pay the same amount per child as couples do, in every state.

Premiums are per-child. Two kids cost about twice as much to cover as one kid; three or more kids cost about three times as much to cover as one child. However, some states have much higher per-child premiums than others. The cost per child is about $450 in Wyoming, but only $220 in Oregon, the family-friendliest state in terms of insurance costs.

How much will a job help with health insurance premiums?

Getting insurance through work averages cheaper than on the individual market, and the gap increases with age. But the difference isn't big.

The cost of adding a partner or children is slightly lower through work than on the individual market. An average individual with no children pays $500 per month for health insurance; $488 if insurance is through work, $513 if it's through the individual market. $25 per month can add up, of course.

It's also worth noting that there are many more plans aimed at the individual market than offered through businesses. Business plans average lower premiums, but it may be trickier to find a plan that exactly fits your situation, especially if you have no children.

ABOUT THE AUTHOR